Retirement tax calculator 2020

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

French Income Tax How It S Calculated Cabinet Roche Cie

Enter a salary you want to live on during retirement in todays dollars.

. Free step-by-step webinar September 19. This should represent a lifestyle rather than an actual income or withdrawal amount. Gross-to-Net is a payroll calculator modeled after the actual payroll calculation program used for state employees pay warrants.

In general investments are used as a method to grow wealth but people who have maxed out their tax. Our retirement calculator predicts how much you need to retire based on your current salary and investment dollars and divides it by. Our retirement savings calculator predicts your total retirement savings in todays amount then highlights how that amount might expand over the years you plan to spend in.

Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. And is based on the tax brackets of 2021 and. Your retirement is on the horizon but how far away.

In a state like Wyoming which has no income tax along with low sales and property taxes retirees can expect to have a very small tax bill. Withdrawals from tax-deferred retirement accounts are taxed at ordinary income tax rates. An inexpensive unbiased customized retirement tax calculator that is easy to use and provides tax answers for you with the click of a button.

Figure your monthly Federal income tax withholding. Federal Tax Withholding Calculator. Federal Employees Group Life Insurance FEGLI calculator.

The AARP Retirement Calculator will help you find the best amount to save to reach your goal. You can use this calculator to help you see where you stand in relation to your retirement goal and map out. WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov.

Or individual retirement account is a tax. These are long-term assets but withdrawals arent taxed as long-term capital gains. On the other hand taxes in a state like Nebraska which.

Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. It is mainly intended for residents of the US. Increased the exemption on income from the state teachers retirement system from 25 to 50.

The exemption increase will take place starting in January 2021. Enter your filing status income deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year we can also estimate.

Lets say Emily age 30 earns 40000 a year and her boss Ebenezer gives 1. Our Retirement Calculator can help by considering inflation in several calculations. A retirement calculator is a simple way to estimate how your money will grow between now and the time you retire if you continue investing at the rate you are today.

This calculator can be used to project changes in deduction. Now is the time to get the tax answers that. IR-2019-155 September 13 2019.

We have the SARS tax rates tables. How Our Retirement Calculator Works.

Download Free Federal Income Tax Templates In Excel

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Withholding For Pensions And Social Security Sensible Money

Tax Calculator Estimate Your Income Tax For 2022 Free

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Withholding For Pensions And Social Security Sensible Money

Taxtips Ca Rrsp Rrif Withdrawal Calculator

Ontario Income Tax Calculator Wowa Ca

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

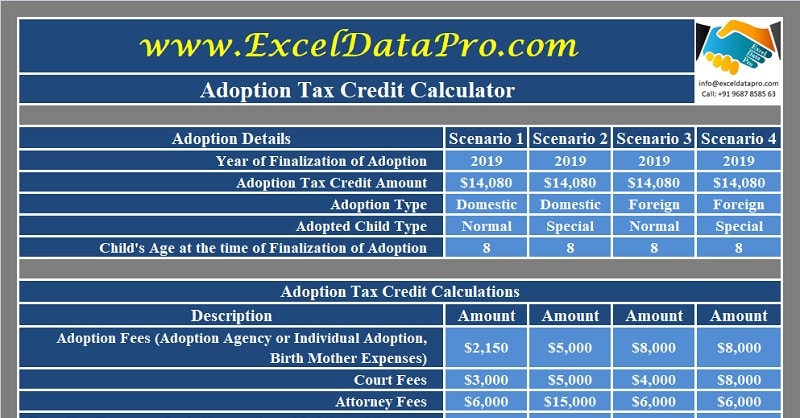

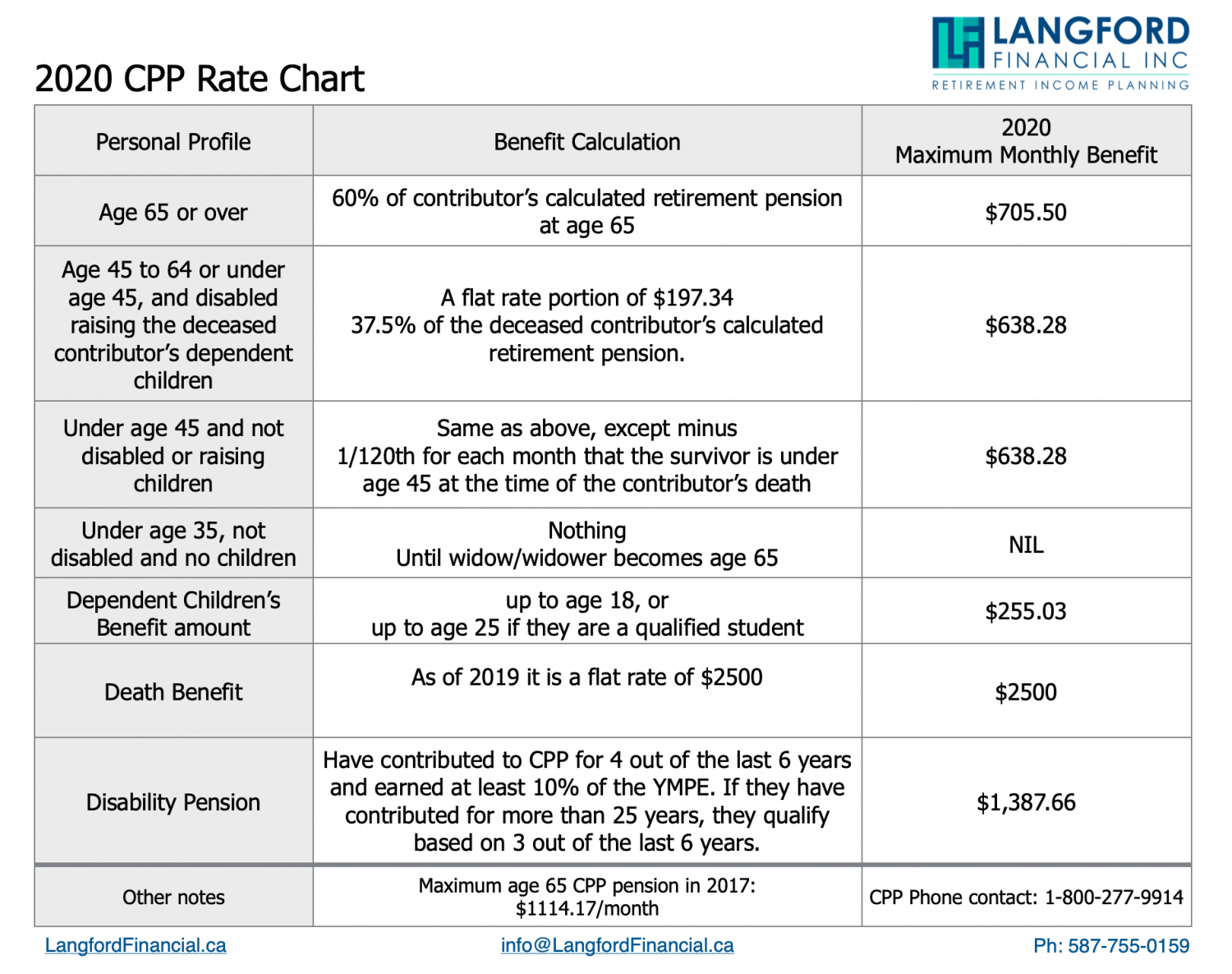

Cpp Benefits For Widows Widowers Children Amp The Disabled

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

2021 2022 Income Tax Calculator Canada Wowa Ca

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download